Overview

The mortgage servicing industry has long loan portfolio lifecycles. During this time borrowers may face a variety of life circumstances that can prevent them from keeping up with mortgage payments. Owing to this, about 2-4% of loans tend to go into default. Infosys’ Mortgage Default Prediction System leverages Artificial Intelligence and Machine Learning (AI/ML) to identify potential loan defaulters and take preemptive action.

Our solution can help mortgage companies flip the industry trend in handling loan defaults by moving from reactive to proactive mode. With a high degree of accuracy in predicting loans that could go into default, clients can rely on our solution to take corrective action with considerable year-on-year savings.

Loan Defaulter Prediction

Enabling Default Prediction Using Artificial Intelligence and Machine Learning

YPR Informatics Default Prediction System uses a combination of available industry data, artificial intelligence and machine learning algorithms to provide the mortgage industry with a fairly accurate view of potential defaulters.

This is how it works. The lending bank has the customer’s loan portfolio. This includes information about any loan payment defaults already recorded in the system. In addition, our solution uses public APIs to collate historic information from mortgage investors such as Fannie Mae and Freddy Mac. Lastly, macro-economic influencers such as unemployment statistics in the area where a borrower lives are gathered from government sources.

This intelligence is passed through the machine learning model to generate a default score for each borrower. On a scale of 1 to 100, the higher the score, the greater the chances of the borrower defaulting on the loan payment.

Clients can use this score to negotiate remediations with the borrowers. This data can in turn be used to automate remediations over time.

YPR Informatics Default Prediction System: A future-proof, automated solution for default prediction

Up until now, there has been no single source of truth that could aggregate borrower and industry data to accurately predict defaults.

Our solution combines modern, scalable technology to provide a future-proof solution that uses:

- Deep neural networks with multiple layers to train the machine learning model

- Explainable AI to highlight potential reasons for default for better risk analysis

- Public APIs from the US government’s Bureau of Labor Statistics to gather unemployment data at job sector as well as the metropolitan statistical area levels

- Correlation analysis to analyze the huge amount of data from mortgage investors Fannie Mae and Freddie Mac

Budget Forecasting

All the financials are calculated for you

YPR Informatics tells you exactly what kind of financial information you need to enter and then it does all the calculations automatically using built-in formulas. So you end up with razor-accurate financial statements that include all the tables that a lender or investor expects to see.

Financial Planning

YPR Informatics brings an opportunity for financial institutions and fintech companies to manage rules effectively and decrease the time between decision design and delivery. We provide solutions for business rules of any complexity, with little or no code.

Clients' expectations are sky-high. In order to meet them, you need a tool that supports decision makers (underwriters, credit policy owners...) to test assumptions and respond immediately to the market. YPR Informatics offers an intuitive and simple UI for daily work with quick adoption time and no need for IT skills.

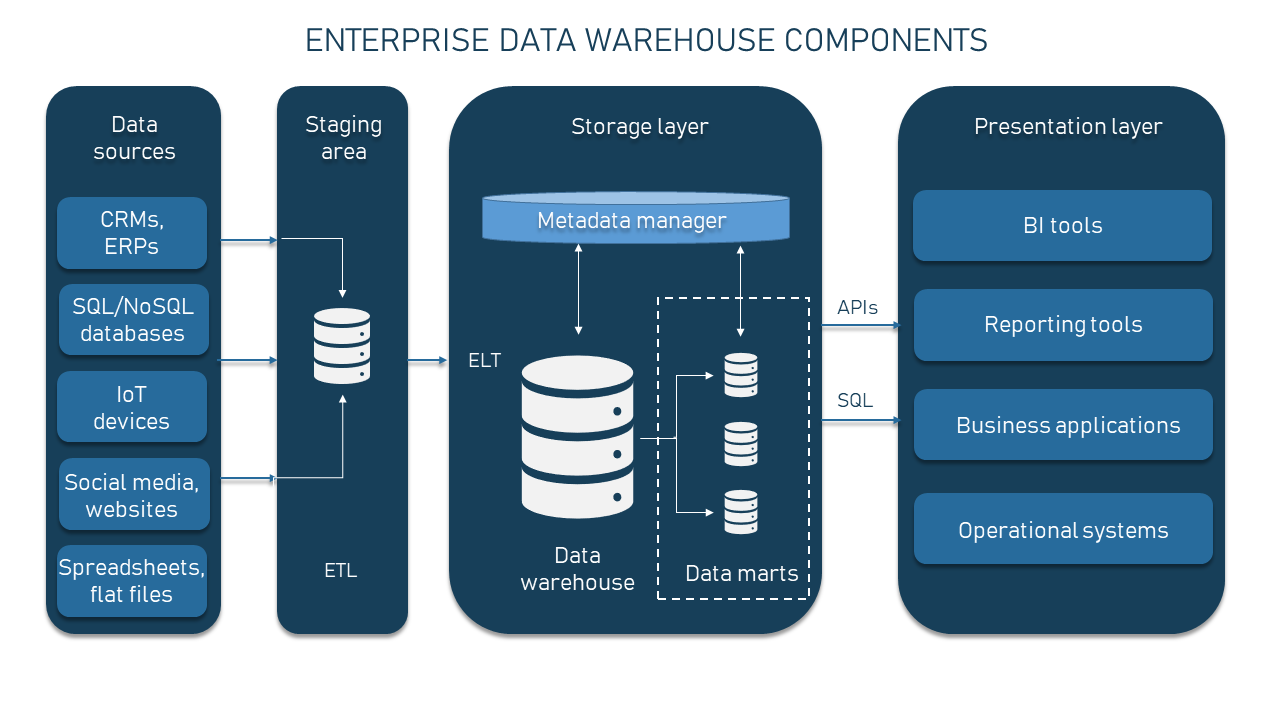

Enterprise reporting & Data warehousing

Throughout the day we make many decisions relying on previous experience. Our brains store trillions of bits of data about past events and leverage those memories each time we face the need to make a decision. Like people, companies generate and collect tons of data about the past. And this data can be used to make better decisions.

While our brain serves to both process and store, companies need multiple tools to work with data. And one of the most important ones is an enterprise data warehouse or EDW.

In this article, we will discuss what an enterprise data warehouse is, its types and functions, and how it’s used in the data processing. We will define how enterprise warehouses are different from the usual ones, what types of data warehouses exist, and how they work. The focus is to provide information about the business value of each architectural and conceptual approach to building a warehouse.

Technologies We Work On

Process We Follow

1. Requirement Gathering

We follow the first and foremost priority of gathering requirements, resources, and information to begin our project.

2. UI/UX Design

We create catchy and charming designs with the latest tools of designing to make it a best user-friendly experience.

3. Prototype

After designing, you will get your prototype, which will be sent ahead for the development process for the product.

4. Development

Development of mobile application/web/blockchain started using latest tools and technologies with transparency.

5. Quality Assurance

Hyperlink values quality and provides 100% bug free application with no compromisation in it.

6. Deployment

After trial and following all processes, your app is ready to launch on the App store or Play Store.

7. Support & Maintenance

Our company offers you all support and the team is always ready to answer every query after deployment.

Industries We Serve

Here, we make almost every genre of applications. You name it and we build it.

Retail, Ecommerce

Education & e-learning

Healthcare & Fitness

Logistics & Distribution

Real Estate

Travel & Hospitality

Food & Restaurant

Gaming

Reach Us

We would be happy to hear from you, please fill in the form below or mail us your requirements

Location:

YPR Informatics Private Limited

Prestige Shantiniketan, Level 2, Cresent Tower 4,

ITPL Main Road, Whitefield, Bengaluru – 560066

+91 80738 32273

+91 80738 32273